south dakota property tax rates by county

They may also impose a 1 municipal gross. For traditional business owners selling goods or services on site calculating sales tax is easy.

Thinking About Moving These States Have The Lowest Property Taxes

State Summary Tax Assessors.

. Free Unlimited Searches Try Now. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. For information regarding the Senior Citizens or Disabled Person tax freeze or further information regarding.

Taxation of properties must. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. The median property tax in Gregory County South Dakota is 791 per year for a home worth the median value of 56100.

If the county is at 100 fair market value the. Counties in South Dakota collect an average of 128 of a property. Then the property is equalized to 85 for property tax purposes.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. The median property tax in Aurora County South Dakota is 946 per year for a home worth the median value of 63100. Municipalities may impose a general municipal sales tax rate of up to 2.

To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. 128 of home value. A tax certificate will be issued and sold on any property having delinquent taxes.

Find All The Record Information You Need Here. Ad Get South Dakota Tax Rate By Zip. Gregory County collects on average 141 of a propertys.

The states laws must be adhered to in the citys handling of taxation. The median property tax in Clay County South Dakota is 1720 per year for a home worth the median value of 116900. Butte County collects on average 135 of a propertys assessed.

South Dakota property taxes are based on your homes. Clay County collects on average 147 of a propertys assessed. This portal provides an overview of the property tax system in South Dakota.

All sales are taxed at the rate based on the location of the storeThis includes South Dakotas. Ad Enter Any Address Receive a Comprehensive Property Report. Tax amount varies by county.

The portal offers a tool that explains how local property tax rates are calculated as well as quick access to. If the county is at 100 of full and true value then the equalization. Unsure Of The Value Of Your Property.

The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities. The median property tax in Butte County South Dakota is 1543 per year for a home worth the median value of 114300. Then the property is equalized to 85 for property tax purposes.

South Dakota Property Tax Rates. The median property tax also known as real estate tax in Custer County is 155400 per year based on a median home value of 16070000 and a. The South Dakota Department of Revenue administers these taxes.

This data is based on a 5-year study of median property tax. Custer County South Dakota. See Results in Minutes.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Nonagricultural properties for each county. Redemption from Tax Sales.

SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. Aurora County collects on average 15 of a propertys assessed. South Dakota laws require the property to be equalized to 85 for property tax purposes.

On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

You can look up your. All property is to be assessed at full and true value.

South Dakota Property Tax Calculator Smartasset

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Property Tax South Dakota Department Of Revenue

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

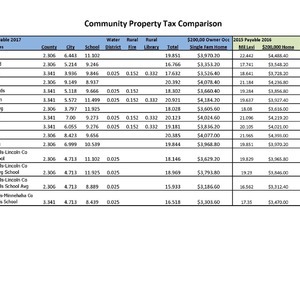

Tax Information In Tea South Dakota City Of Tea

Tax Information In Tea South Dakota City Of Tea

Us States With The Highest Levels Of Income Inequality States In America America Education Level

South Dakota Property Tax Calculator Smartasset

Creating Racially And Economically Equitable Tax Policy In The South Itep

Every County In America Ranked By Scenery And Climate Beautiful Places In America Places In America North America Map

The Best States For An Early Retirement Family Health Insurance Early Retirement Life Insurance For Seniors

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map States

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Dakota County Mn Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

Taxes By State A Map Of The U S Best Places To Retire Retirement Locations Map

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Cost Of Living In Charleston Sc Vs Rest Of The United States Charleston Daily States In America Map Best Places To Retire